Clinton and Todd explore the evolving landscape of homeownership, offering insights and expertise! Join us this episode of Mortgage 101, as we dive into discussions ranging from Halifax's growing reputation, to the nuances of mortgage lending.

Mortgage 101 – Challenges for first-time and pride community home buyers | August 2021 Part 1

In this episode of Mortgage 101 with Clinton Wilkins and Todd Veinotte, as heard on News 95.7, the guys talk about challenges for first-time and pride community home buyers, opening a bank account in the 1950s and 60s, and lenders’ questions about borrowers’ relationships.

Mortgage 101 with Clinton Wilkins & Todd Veinotte – August 2021 – Part 1

Don’t feel like watching the video? Check out the transcript below.

Transcript:

Challenges for first-time and pride community home buyers

Todd Veinotte: [00:00:00:06] Alright, so we’re going to talk about pride and homeownership, and it kind of goes without saying that homeownership and pride should go together, because it is, as you always say, the biggest purchase of your life. Right? And people should take pride in that.

The fact that, first of all, not everybody gets to own a home. And I think that we’re entering an era now where it is becoming somewhat, I don’t want to say rare, but it’s not as common as it once was, right?

Clinton Wilkins: [00:00:29:10] Yeah. And I think that it’s definitely harder for first-time home buyers now than it ever was before. And, you know, specifically when we’re talking about pride and, you know, if we’re talking about, any same sex couples, I think it was even challenging for individuals to be able to buy a home even before now.

So I think, you know, some of the struggles that first-time home buyers are facing today around affordability, it probably was the same type of struggles only, you know, things change over time. I think one the big things today is that first-time home buyers are having a super hard time getting the funds together for a down payment and closing costs, but also that affordability.

Low percentage of same sex couples owning homes

You know, there’s a really low percentage of homes that are owned by, you know, same sex couples. And you know what? I’m not sure why that is, you know, a low percentage. I think, you know, one thing that we kind of think about is sometimes there’s some socioeconomic challenges. I think that’s certainly one and, you know, I think when we think about homeownership. It’s about putting roots down in the community, and I sometimes feel like it is challenging, you know, no matter what type of group that we’re talking about to break that barrier down and, you know, it’s 2021.

Clinton Wilkins: [00:02:00:04] A lot of the barriers have been broken down. But I think it’s so important to talk about it. And, you know, if we’re thinking about, you know, pride and we’re thinking about, you know, first-time home buyers, there’s a lot of things that are kind of similar to the challenges.

New challenges for everyone will be around affordability

And I don’t want to discount it, Todd. I don’t think it’s a walk in the park for anyone, becoming home owners. And I think even for people who do own homes, I think that’s also challenging. And I think that’s something that we have to also think about. We need to remember that it is challenging and everyone’s challenges are a little bit different. So I think it’s certainly an interesting time, 2021.

We would think that things have certainly gotten a lot better for a lot of groups, but I don’t think we’re all the way there. And I think that we’re going to see some new challenges come. And some of those new challenges are certainly going to be around things like affordability and, you know, just access to be able to finance that home.

Story time: opening a bank account in the 1950s and 60s

You know, at one time. And here’s something that’s kind of interesting. Our new office is in downtown Halifax at 5151, George, which is the old Bank of Montreal building, and I’ll throw it out there that it was Bank of Montreal.

Clinton Wilkins: [00:03:21:22] I think everyone kind of refers to this building as the Bank of Montreal building. We don’t do business with Bank of Montreal, but we certainly do business with, you know, a lot of the big five lenders.

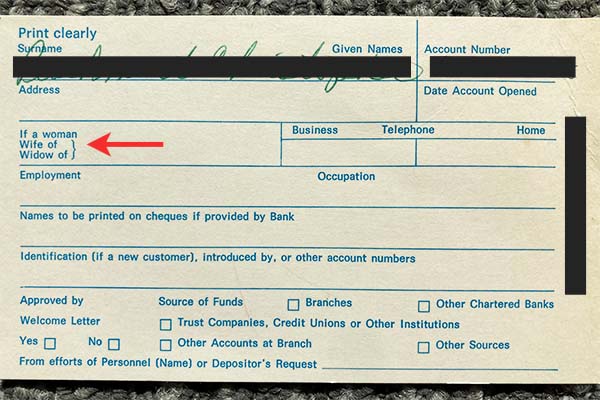

And when we were renovating this new office, we found some old, you know, not so much documents, but I guess kinda documents from Bank of Montreal. And it was an old signature card that we found, you know, probably from the 1950s or 60s, and the primary person on the bank account was, you know, a male. And if there was a secondary person on the account, it was a female. And if the primary person on the account was a female you had to write “wife of”. Those were the only choices.

The choice was either it’s single male or a husband wife, or if it’s going to be a woman opening a bank account you had to write who the husband was, of that person. And, you know, obviously things have changed over time, but I can’t imagine how challenging it would be for a same sex couple in 1960 to get a mortgage from any financial institution.

Lenders ask more questions about borrowers’ relationships

I can even tell you, in the 15 years that I’ve been doing mortgage lending, I get asked all the time, what’s the relationship with these two borrowers? And we’ll code it correctly, we’ll say single, single, but together.

Clinton Wilkins: [00:04:52:13] Common law, common law, but together. Married, married together. One’s divorced, one single, but together. And you know, we get asked the question all the time and it’s kind of innocent. But underwriting will come back and be like, what’s the relationship with these two borrowers? And it’s not just because it’s, you know, two same sex borrowers. It’s two of any borrowers.

They ask a lot of questions. And there’s more questions that get asked today than I think probably any other time. You know, the pendulum really swings kind of both ways. When I first started 15 years ago, we could just kind of throw something at the wall and see if it would stick. And now we have to diaries more and more information and we get asked a lot of questions.

And I sometimes feel sensitive to the questions because not everyone wants to be asked, you know, what is the situation? But when you’re doing something that is the biggest purchase of your life, and that’s certainly buying a home, the mortgage is the biggest debt, we kind of have to give all those pieces of information just so make sure that, you know, obviously the lender understands what that kind of risk looks like.

Todd Veinotte: [00:06:09:01] Wow. There’s a lot there, to unpackage, actually. And I feel as though there’s more to that conversation. But we’re going to need a break. So can we revisit that?

Clinton Wilkins: [00:06:19:04] 100 per cent.

Todd Veinotte: [00:06:19:26] Okay, Mortgage 101: Your Guide to Homeownership with Clinton, Wilkins and myself, your host Todd Veinotte. We’ll be right back.

If you have any questions, get in touch with us at Clinton Wilkins Mortgage Team! You can call us at (902) 482-2770 or contact us here.