How fast can you pay your mortgage off? Can you speed up the process? Here’s what you need to know!

Pride in Homeownership 2022

It’s time for the Pride in Homeownership 2022 Workshop! Join Mortgage Broker Clinton Wilkins, Real Estate Agent Jules Chamberlain, Real Estate Lawyer Danielle MacLean, and Global News Morning Host Alyse Hand to discuss all your questions around first time home buyers and homeownership for the pride community. The panellists discuss home buying challenges for the LGBTQ+ community, joint tenants versus tenants in common, inclusive neighbourhoods, pre-approvals, cohabitation agreements, matrimonial property act, student debt, bankruptcy, and so much more.

Don’t feel like watching the video? Check out the transcript below.

Transcript:

Welcome to the Pride and Homeownership 2022 workshop!

Alyse Hand: [00:00:00:04] Hi, everybody. Good evening. Great to see everybody out here tonight. It’s funny, I drove in from the valley. I moved to the valley. I’m a city girl. I’m from Halifax, from Bedford. But I drove in from the valley and it was 33 degrees and just stifling. So it’s actually, as much as I think some people are going, “Why is it as warm as Elise said it was going to be on the news this morning?”, it’s kind of nice because I think other parts of the region right now are like, “Get me out of this heat.” So, thanks for being here.

I am Alyse Hand. I co-host Global News Morning. It’s a morning news show here in Halifax, 6 to 9 a.m. on Global News. If you’re able to tune in weekdays and I’ve been in the TV and news industry for about 15 years now, I’ve known Clinton Wilkins for the majority of that time. He’s become a dear friend of mine. And I’ve been moderating this event, I think, for about three years now. I think this is our third one. We were we were sidelined because of COVID, but we’re back and better than ever in this new space.

Alyse Hand: [00:00:53:15] So thanks to everybody for being here, for Pride in Homeownership. We’re going to have a great discussion tonight and I’m going to introduce you to our lovely panellists to the right of me here.

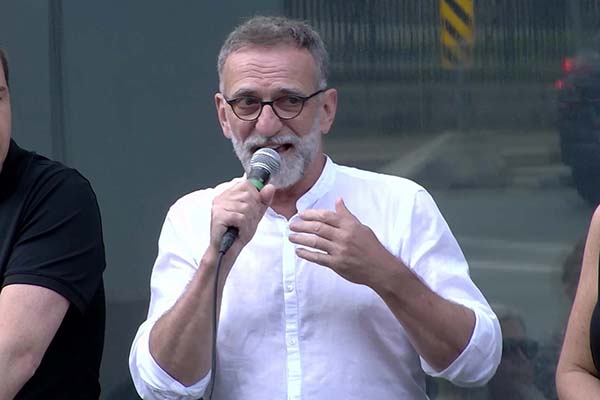

Welcome mortgage broker Clinton Wilkins to the panel

I’m going to start with Clinton. He is the founder of one of Canada’s top performing brokerages and is the current Canadian Broker of the Year. He’s a big deal. And that’s for under 25 employees.

He began his career as a mortgage broker back in 2006, and with the goal of providing a better mortgage experience for clients and supporting Atlantic Canada’s growing economy, Clinton has always been a forward thinking professional and a great friend, too. And when Clinton is not working in the office, he can be found co-hosting Mortgage 101 on CityNews 95.7.

He’s also a regular contributor to our morning show on Global News Morning. You might see him on the air, and CTV’s Morning Show as well. Clinton literally wrote the book on mortgage lending. He wrote a book. When were you, like, 14? At the time?

Clinton Wilkins: [00:02:00:14] Might have been a couple of years ago. I don’t know.

Alyse Hand: [00:02:02:05] Confessions of a Halifax Mortgage Broker. And it’s a it’s a great read. And it’s still something that a lot of people go to for information when they don’t go to Clinton himself.

So when Clinton is not working in his office, he is doing all sorts of things. I know I see him all around the town and giving back and philanthropy. And this is one of those things he chose to do tonight was give up some of his time after a day at the office to speak with us also. Clinton Wilkins, everybody, give it up.

Clinton Wilkins: [00:02:30:03] Thanks for coming. Thanks, Alyse.

Welcome real estate lawyer Danielle MacLean to the panel

Alyse Hand: [00:02:33:23] Yes, of course. And Danielle MacLean is right here to the right of me. Danielle is the owner of DCL Law. She’s originally from Florence, not Italy. Florence, Cape Breton in North Sydney. She’s our resident, Cape Bretoner on the panel today. She’s a graduate of both St Mary’s University and Dalhousie University. She was admitted to the Nova Scotia Bar in 2004. Her legal practice includes real estate — how appropriate — wills, estate planning, contracts and corporate law. I was listening to Danielle. We were on a call to kind of preparing for this the other day. And I’m just like, this is like, it was amazing. The wealth of knowledge that this woman will be able to provide you tonight for free is incredible and she’s just great. So, Danielle, thanks for being here.

Danielle MacLean: [00:03:21:15] Yeah, thanks for having me.

Welcome real estate agent Jules Chamberlain to the panel

Alyse Hand: [00:03:23:09] And finally, Jules Chamberlain, you’re the last one there to get to Jules. He is a real estate agent at Red Door Realty and is fluently bilingual in both English and Francais.

He hails from Bathurst, New Brunswick, in northeast New Brunswick, and he returned to the Maritimes after living, get this, in rural eastern Ontario and Ottawa with boats in Montreal, Toronto, Boston and Paris. He’s a bit of a world traveller, so he’s seen it all. But it’s so cool to know that it came back here to kind of lay his roots.

He has been working in real estate for over a decade now, but before that spent more than two decades, more than 20 years, designing and renovating homes. So he really is the full package. He knows it all. He brings this knowledge of both the decorative and structural aspects of a home with him when evaluating any property. So give it up for Clinton. Jules and Danielle are panellists this evening.

Question one: tell us about you

And we’re going to get in right into the questions. We’ve got lots of them that we’ve kind of spent some time together thinking what would be the questions that others would want to know? But we are going to leave some time tonight for you to ask some questions as well.

So if you have any or you start to think of some, just keep them in your mind. And at the end of this session, we will give you the opportunity to ask some questions. So first question and this is for all of you. So, Clinton, I’ll start with you.

Clinton Wilkins: [00:04:41:01] Okay, perfect.

Clinton: tell us about you

Alyse Hand: [00:04:41:20] This is a tough one. Tell us a little bit about yourself.

Clinton Wilkins: [00:04:44:12] Oh. I love all the trick questions. I mean, Alyse is a professional interviewer. We’re just, you know, amateurs, maybe on a stage, but maybe professionals in what we do every day.

Alyse Hand: [00:04:54:04] Sure.

Clinton Wilkins: [00:04:55:00] I’ve been a mortgage broker here in Halifax. I’m born and raised in Nova Scotia. I’ve been in the industry for 17 years, and we’ve overseen, like I’ve overseen almost 5,000 transactions. So every day I think I’ve seen everything. And then I see something new, which I think is really cool.

And I think over the last couple of years there have been such a big shift in talking about homeownership and real estate and mortgage lending. And you know what? I’m glad that at least we’re part of that conversation.

And I think homeownership really is more important now than maybe it ever has been, and especially over the last couple of years, like everybody’s needs and wants have changed. And I’m glad we’ve been here to be able to help people that live here in Halifax and Atlantic Canada and really across this country.

Jules: tell us about you

Alyse Hand: [00:05:40:26] Great. Jules, I’ll hand it over to you. Tell us a little bit, other than what I said there, there’s lots more to Jules. So tell us about yourself.

Jules Chamberlain: [00:05:47:14] Thank you. I originally was going to come here to study in architecture. Way back when I was 16 years old, I came to visit Halifax, and somehow life took me elsewhere. And I ended up in Ontario and living in Ottawa.

And I did a lot of other things other than architecture for a while and studied business. And I’m a business people person, got into food, into group dynamics and a variety of different things, and then came back to construction and did that for most of my adult life in Ottawa, in the Ottawa Valley.

But all those years I knew I would come back to the ocean. And though I had community and home and career and friends up there, one day as planned and expected, I woke up and it was like, “Oh, time to come back.” So Halifax is home and I love it.

And I never thought I would get into real estate. As much as I love buildings, construction, architecture, design, and especially interiors. But it just seemed like the natural progression, succession to what I was doing. So this is semi-retirement. There’s still yet another career in me. Yet some years away. Some years away.

Alyse Hand: [00:07:07:20] I’ll be introducing you again in a few years in a completely different capacity.

Danielle MacLean: [00:07:10:29] We already have a lawyer.

Danielle: tell us about you

Alyse Hand: [00:07:14:08] We’re glad you made here your home because you have so much knowledge and we’re glad you’re here this evening, Jules. And Danielle, tell us a little bit about yourself before we dive into some more questions.

Danielle MacLean: [00:07:22:29] All right. Well, I am not as interesting as Jules. I’ve really just, I’m just a lawyer. I you know, in my spare time, I like to drive my children to sporting events and try to sit on a stool in front of crowds in a dress. But I’ve been practicing real estate law almost exclusively for close to 20 years. And what I would like to see everybody take away from this is that homeownership is possible. It just may not look the way you think it traditionally has looked.

Question two: how to begin the home buying process

Alyse Hand: [00:07:55:01] Good, good way to kind of start things off. And we’re going to dive into that for sure here in a second. And for all three of you and Clinton, we’ll start with you again. If someone is thinking about becoming a home owner, let’s just start here. Where do they start? What’s the first step?

Clinton: how to begin the home buying process

Clinton Wilkins: [00:08:08:20] Well, I might be a little bit biased working in the mortgage industry, but I think a really good place to start is getting a pre-approval, you know, knowing what you can afford. Knowing what the mechanics look like, I think is really important, you know?

And I think you really need to understand what your budget is and you need to know how much funds you need. And I think it’s a really good foundation. And typically majority Canadians need a mortgage.

So, you know, if you can’t get the mortgage and if there’s certain nuances that may impact that negatively, I think it’s a good place to start in a good foundation. And we see a lot of people kind of starting with getting that pre-approval in place.

Jules: how to begin the home buying process

Alyse Hand: [00:08:49:08] I can attest to that. Yeah, for sure. And then Jules, first step.

Jules Chamberlain: [00:08:53:19] Absolutely, actually and Clinton didn’t nudge me to say this, but that is the first thing that I would say is get a pre-approval, then we can work in a realistic range. You know where that ceiling is of what we can look for. It’s heartbreaking to look for a place, fall in love with it, and then find out you can’t afford it.

So it gives us a range of what we can work, where we can work, what we can look for. And then, get a good realtor. Find somebody that you’re going to be comfortable with because you’re going to be spending a lot of time, you’re going to be spending a lot of time looking at stuff and somebody that can be sensitive to your needs and then… the next step.

Danielle: how to begin the home buying process

Danielle MacLean: [00:09:39:24] I’m the last step

Clinton Wilkins: [00:09:40:24] This is a natural segway.

Danielle MacLean: [00:09:42:02] I’m the last step, but I would say from the beginning, in addition to kind of getting your people lined up, you really want to figure out what it is exactly that you want.

And we had a conversation the other day about this and about the difference between a want and a need and how important it is to understand what you really need and what you would like to have. So I think that’s important as well when you’re when you’re kind of starting out.

Question three: home buying challenges for the LGBTQ+ community

Alyse Hand: [00:10:08:07] All right. Great, great, great, great guys. So we’re getting the conversation started. And, you know, this is all about Pride and Homeownership. It is pride, everybody, so happy pride to everybody attending. I’m a cis white female. And so when I sort of first found out about this, I went, what there’s challenges if you’re in the queer community for buying a home and what are those? So I want to start with that question because that’s really what we’re here to talk about and then we’ll kind of we’ll break things down further. But, maybe I’ll start with you. I know I’ve left you to do the third answer every time, Jules or excuse me, Danielle. I’ll start with you. What challenges do you see for the for the LGBTQ+ community in this area?

Danielle: home buying challenges for the LGBTQ+ community

Danielle MacLean: [00:10:47:11] Well, I think everybody right now is having the same challenges or a lot of the same challenges. And, you know, if you listen to the news and you’re reading the paper, there’s a lot of sensationalism in there. You know, homes aren’t attainable, they’re not affordable.

You know, the average house price is these competitive bids. And, you know, I think part of that, I think people stop themselves before they even try to get into the game and they assume that they can’t.

And, you know, part of what I’d like to talk about a little bit later on and some of the other questions are, you know, how it can look and how you can really, how you can make that happen. And it may not be what we traditionally think of with like, you know, like a married couple going and pooling the resources and buying a house.

Alyse Hand: [00:11:32:07] Yeah, great. And, Jules, I’ll let you answer that one.

Jules: home buying challenges for the LGBTQ+ community

Jules Chamberlain: [00:11:36:20] It’s hard to say what might be would be the specific challenges for our community in particular, because buying out and owning a home is not specific to what we do in bed or are specific to our identity. There’s, like Danielle is saying, is that there’s challenges for everybody.

I’d say the first challenge is what separates renters and owners is that big hurdle that we know is the down payment. And for those of us who. I mean, you know, once you have a mortgage, once you have a home, we all adapt to whatever our expenses are every month.

Once we’re in a home, it’s the same thing. We adapt. It’s not that different. But that big first hurdle is the first big challenge, and that requires whatever organizing, or whatever it takes to squirrel away, sock away, organize your life to be able to make that step forward.

Alyse Hand: [00:12:42:13] Clinton I’ll get you to answer that one, too.

Clinton: home buying challenges for the LGBTQ+ community

Clinton Wilkins: [00:12:44:25] I think for me, I see a lot of single individual borrowers, and it may be just one borrower on application. And I think one of the biggest challenges that I see right now is around the household income, because obviously the cost of real estate is more expensive now than it has been over the last couple of years.

You need more income now to qualify kind of for an average home than you did before the prices started increasing. So I really find income is kind of the biggest challenge that I see across the board.

You know, in the queer community, I think there’s sometimes some socioeconomic challenges or maybe that idea that there are socioeconomic challenges. But I can tell you, we see borrowers every day and the incomes are actually pretty strong here in Halifax. You know, I will echo what Jules said. You know, down payment is a hurdle.

I don’t find it the biggest hurdle, though, I would say the biggest hurdle is the household income. And I would say, secondly, the next hurdle is really around the credit worthiness and really, I think education around credit and financial health and things like that.

Question four: joint tenants versus tenants in common

Alyse Hand: [00:13:52:26] For me, and I bought my first home, a condo a couple of years ago. It was just knowing where to start. Like, what’s the, you just kind of have to Google it. What do I do? And I want it, so and I mean, the mortgage broker avenue is what I did. And again, Clinton did not ask me to say that that’s just the route I took and it worked out. So good. Good stuff, guys.

We’re going to keep it rolling here. I know we only have about 45 minutes to go here. So, Danielle, I’m going to ask you the next question. What are the pros and cons of joint tenants versus tenants in common? Maybe you can break that down for us a little bit and tell us what the pros and cons of each one are.

Danielle: joint tenants versus tenants in common

Danielle MacLean: [00:14:25:25] Okay. That’s a big question. So this would be when you’ve already got your accepted offer and we’re closing your transaction. So your lawyer is going to ask you if it’s not just you purchasing, if you’re purchasing with somebody else. How you want to take your title. So there’s different ways to do that.

So one would be joint tenancy. So that means if one of the owners dies, whoever’s left is going to get the property automatically. So you don’t have to deal with wills, inheritances, anything like that. And we’ll see that a lot of times when people are partners, so romantic partners. So you want to make sure that your partner is going to get the property.

Tenants in common means that you each own your own share. So it doesn’t have to be 50/50. It could be something different. Maybe you’re buying with a friend, maybe you’re buying with a partner, but you want to keep your assets separate.

So it could be if I contribute 25% and Jules, contributes 75%, perhaps he’s a 75% owner and I’m a 25% owner. That can work really well if you’re doing something with someone that you’re not in a romantic relationship with, sort of like more of a business type transaction, or if you just want to make sure that your investments are protected.

Now, the danger of the tenant in common situation is if I pass away, then Jules is going to find himself owning with someone with 25% share that whomever inherited my estate.

Danielle MacLean: [00:15:50:19] So you need to kind of remember that. We can play around with that. We can do some side agreements, we can do some trust agreements. There’s ways around all of that.

The only caveat I would have there would be sometimes lenders are going to dictate how you hold title. So we’ll see that frequently where a lender will say everybody has to be joint tenants and that can be a problem because sometimes people are just adding on a parent so that they can qualify.

Kind of speaking to Clinton’s saying there, you know, with the household income, I’m seeing more and more now that we need to add on parents, friends, whomever, so that you have that income and they’re really just there for qualification purposes. But your lenders requiring that you be joint tenants. So if you pass away, that person that was just there for qualification purposes is going to inherit that property. You might not want that in particular.

If it’s just you on title and you know you’ve got a partner or someone else that you want to get that. Again, we can always play around with that. And those are discussions you can have with your lawyer. There’s a way around everything. That’s what I’m there for. But, you know, we can do those side agreements.

Clinton Wilkins: [00:16:51:01] Really know what you want, I guess.

Danielle MacLean: [00:16:52:00] Know what you want going in and make sure your lawyer knows what you want and make sure that someone’s not just defaulting you to something that you may not necessarily want. In particular, when you’re looking at not everybody that you want to own the property being on title, it’s really important that you have those discussions.

Question five: inclusive neighbourhoods

Alyse Hand: [00:17:13:18] Okay. Good advice. We did our little pre call for tonight this question, this next question came up and I know there was a little bit of like, how do I answer this one? But I’m going to ask it to Jules. And I really don’t know what you’re going to say here tonight, but.

Jules Chamberlain: [00:17:31:08] I get all the trick questions.

Clinton Wilkins: [00:17:33:22] Or maybe the hard questions? I don’t know.

Alyse Hand: [00:17:35:16] We know you can handle it.

Danielle MacLean: [00:17:36:13] The legal questions. Come on.

Alyse Hand: [00:17:38:11] That’s right. She gets the really tough one. Jules, what neighbourhoods are most inclusive? Are they’re more inclusive? Like we’re in Halifax.

Jules: inclusive neighbourhoods

Jules Chamberlain: [00:17:44:05] I knew that one was going to come up. Okay, so that’s a very difficult question to answer without sounding disparaging of other neighbourhoods.

You know, it’s 2022. We have come a long way, so things have changed a lot rather than, you know, I’ll generally say anywhere that is more younger, happening, hip, or up and coming are the areas that you’re more likely to see more diversity and more openness.

But then I also want to say you have to go on a one on one basis when you’re doing viewings, when you’re shopping, when you’re going through that whole process of elimination to arrive at the right place.

Have an eye, check out your environment, see what the neighbourhood is like and what you see in the neighbourhood. Sometimes there’s signs that just go, “Oh, maybe not here,” but I’m happy to say, I’m happy to see, that we have come a long way.

Alyse Hand: [00:18:46:14] So I think it’s such a word of mouth thing too, we’re in Halifax. It’s not Toronto. So you just talk to people and you kind of know if you’ve lived here for long enough, I guess where you might want to go. What about you, Clinton? You’re kind of looking at me. Do you have something you want to say?

Clinton: inclusive neighbourhoods

Clinton Wilkins: [00:18:58:03] Yeah, like, I don’t know. For so long we were saying, like, the North End is the hot spot to be. But, you know.

Jules Chamberlain: [00:19:04:16] It is one of them.

Clinton Wilkins: [00:19:05:15] I mean, it is a hot spot, but I’m seeing so many buyers. Even like a lot in the queer community that we represent, are buying homes in Dartmouth, like downtown Dartmouth and North End Dartmouth is like super hot. I’ve actually lived in North and Dartmouth myself, and I think it’s a pretty good place to live.

We have some other Dartmouth residents here, but I’m seeing a lot more popularity there. And I would even say the last couple of years we’ve seen a lot of price growth kind of in that Dartmouth between the ‘cerc’ and the ‘bihigh’ seems to be kind of the biggest.

Jules part two: inclusive neighbourhoods

Jules Chamberlain: [00:19:37:05] And on the peninsula here, I’d also say, like it’s because, there’s actually four zones. Most non realtor people wouldn’t know this. There’s four zones on the peninsula.

So most people consider anything north of Citadel Hill as the North End. But really there’s a whole neighbourhood there that’s called Central Halifax and so the central area, so around Haliwood or, you know, where Gottingen and Agricola. Right? That’s that whole area is very hot and fabulous place to live actually. And you’d have me as a neighbour.

Alyse Hand: [00:20:13:09] And you’d have LF bakery in your neighbourhood, too.

Clinton Wilkins: [00:20:15:28] I mean, who doesn’t like a nice little treat.

Question six: pre-approvals

Alyse Hand: [00:20:18:15] And dangerous. Take it for me. Okay. Clinton, what advice do you have for someone looking to get pre-approval?

Clinton: pre-approvals

Clinton Wilkins: [00:20:24:01] Oh, have your documents together. That was my number one suggestion. You know, if you’re employed with an employer, you know, have your pay stub, have two years of your T4s. If you’re just starting a new job, you know, have a letter from your employer to state what your salary is. So I think that’s huge.

And I would also say my little pro tip for the day: download Borrowwell and download Credit Karma. They’re free apps. One brings in the data from Equifax and the other brings in the data from TransUnion. Know what your credit looks like.

Oftentimes, you know, there’s little surprises on there, and sometimes there’s errors that we are able to fix or able to help fix. But I think it’s good to know kind of what your credit looks like and then have your documents together. I think that’s huge.

Alyse Hand: [00:21:06:23] Is it fair to say, you know, before you do anything, work on your credit, before you go looking for a home? Or do you think that’s an afterthought?

Clinton Wilkins: [00:21:14:01] You know, majority of Canadians have very good credit, but I think know what’s going on. And I think, you know, if you’ve had bad history in the past, you know, maybe you’ve had some loss of employment, health issues, matrimonial breakdown, loss of business, the pandemic. You know, EI, there are things that we can explain.

And if it’s a momentary kind of blip in that credit worthiness, you know, there’s an exception to every rule. And we’re certainly willing to work with people. And I think mortgage lenders in general really want to make it happen.

Everyone on this panel, all three of us, were all self-employed. So we really like to work with people. And I think mortgage lenders in general want to work with Canadians to make it happen. But I think know where you’re at. I think that’s the big step. Awareness.

Jules: pre-approvals

Jules Chamberlain: [00:22:03:05] A little tail of warning or a cautionary tale is the expression on that is pre-approval does not guarantee approval. So you want the pre-approval to know where, not to go into your field, but it just it reminds me of a story. Once you get your pre-approval, be mindful of what you do between the pre-approval and putting in an offer.

Clinton Wilkins: [00:22:29:02] Don’t go buy a new car.

Jules Chamberlain: [00:22:30:24] Bingo.

Clinton Wilkins: [00:22:31:13] And maybe don’t change your job.

Danielle MacLean: [00:22:34:05] No furniture loans.

Clinton Wilkins: [00:22:35:16] No. Make your payments.

Jules Chamberlain: [00:22:37:04] I had a client without telling me, had gone ahead and leased a new car and then we put in an offer and she was shocked that she didn’t get approved because her numbers weren’t the same anymore.

Clinton part two: pre-approvals

Clinton Wilkins: [00:22:48:29] Honestly, it would surprise you how many people buy a new car as they’re buying a house. It would surprise you. It doesn’t surprise me anymore, but it really does happen. I mean, accidents happen, you know, car accidents and things like that.

And, you know, if it’s a one for one trade off, it maybe not be that big of a deal. But sometimes having new credit will bring down your score temporarily, especially like if it’s a brand new loan at max, that can make a difference. So I would say keep everything the same when you make a pre-approval, obviously increasing your savings, not a bad idea, but don’t increase your indebtedness.

Question seven: cohabitation agreements

Alyse Hand: [00:23:21:24] Yes, great. Great advice there, guys. It’s funny, I’m in charge of the time. Clinton was like, if there’s one thing you do tonight, keep us on track. And I didn’t bring a clock.

Clinton Wilkins: [00:23:30:27] That’s all right.

Alyse Hand: [00:23:31:26] Can anyone just give me a time check to see where we are? 6:30 okay, we’re halfway through. Okay, so we should get to the next one. Danielle, we haven’t heard from you in a while. What should people think about when they’re thinking about cohabitation agreements? When should people think about cohabitation agreements?

Danielle: cohabitation agreements

Danielle MacLean: [00:23:47:00] You should think about a cohabitation agreement at any time you’re going to cohabitate. That is the most valuable piece of paper that you will ever have. And your worst case scenario is that you never need it and you don’t have to worry that someone’s there for the wrong reasons.

So cohabitation agreement can protect you and it can protect your partner as well. So you can put anything and everything in there. So if you’re looking at buying, you can say that the property stays yours or you get your equity back. Or maybe it’s just you on title because your partner’s not going to qualify to be on there, but you can also put in there that they do have an interest in that property.

You can deal with anything and everything other than child support. So you can deal with spousal support, you can protect your pensions, you can say who’s going to deal with debt. I always say, you know, paper makes good friends and it makes for good break-ups, because you know where you’re going to be, you know? But we’ve all been there.

Clinton Wilkins: [00:24:40:22] And I’ve been through a break-up or two.

Danielle MacLean: [00:24:43:00] The hardest part and one of the hardest parts of that is not knowing where you stand. You know, are you going to be able to afford to stay in your home? Are you going to be able to afford to pay your bills? Are you going to get stuck with their debt?

You’ve got that piece of paper at least to know where you stand. So, you know, cohabitation agreements, there are friends unless the person you’re moving in with is really rich, then maybe not, but you should always.

Clinton Wilkins: [00:25:05:26] But that wasn’t legal advice.

Danielle MacLean: [00:25:06:28] You should always have a cohabitation agreement. And you know, they can roll right over to marriage. So it’s not something that’s going to die if you get married. That’s something you know that can be a hard conversation to have, but it’s an important conversation to have.

And, you know, if somebody doesn’t want to enter into one, you should kind of wonder why and maybe think twice about moving them in with you. But good tool to protect everybody, including the person you’re moving in with.

Clinton Wilkins: [00:25:31:07] And just to like throw myself under the bus a little bit and our listeners at home. So thanks for tuning in on Facebook or YouTube or wherever you’re listening. I’m actually entering into a cohabitation agreement with my boyfriend.

We’ve been working on like the legal document. We agreed on the terms. It’s not executed yet, but I’m going down that path as well. I think having it on paper so important.

Question eight: finding a team of professionals

Alyse Hand: [00:25:52:25] Starts off great. I’m also about to move in with somebody and we haven’t discussed that yet. It’s been one of those things where I’m like, I’m not ready to talk about that. So I’ve got to do that and I needed that. Thank you, Danielle.

Jules, are there any challenges with any neighbourhoods and homeowners being accepted into the community? This kind of goes back to our last question. Yeah, yeah. Okay. Let’s get another one for you.

Jules Chamberlain: [00:26:15:11] Or did you want me to ad lib?

Alyse Hand: [00:26:16:10] Yeah, go ahead. I feel like you have something to say.

Jules: finding a team of professionals

Jules Chamberlain: [00:26:21:11] Yeah, I’m usually a motormouth. Buying a home is a huge undertaking. And so find the right team of people to work with you that understand and respect that. And like I said a while ago, find a realtor that you can work with because you’re going to be spending a lot of time, right?

Find somebody that’s not just chasing after a paycheque or chasing after a quick sale and don’t buy a consolation prize. Be patient and find the right place for you. Right? It’s got to be what you’re looking for is good location, good bones, good systems.

Clinton Wilkins: [00:27:01:16] You can’t change the location.

Jules Chamberlain: [00:27:02:23] No, you can’t change the neighbourhood. You can’t. There’s so much of that. So of the things that you can’t change, can you live with them? Of the things that you feel you need to change. What’s it going to cost?

And any address can have a brand new kitchen. There’s a cost to that, but there’s also a cost, an extra cost of buying one that has had a new kitchen put into it. So find something that’s got a good location, that’s got good bones and good systems, and then do the cosmetic, do the fun thing yourselves. Right? But don’t buy a consolation prize.

Danielle MacLean: [00:27:37:23] Someone had said to me once, don’t focus on the lipstick of the house.

Jules Chamberlain: [00:27:41:02] No, no. Too often lipstick is smoke and mirrors. So you need to look at it from a multiple angle of making sure that it makes sense structurally and it makes sense as an investment.

For now, you need to make sure, of course, that you can afford it. But what’s it like for later? Because at some point you or your successor is going to need to sell it. So if is that neighbourhood going to allow for a certain amount of lift, is the structure strong enough? Is that a good base, a good canvas on which to paint your dream? Right?

Question nine: fixed or variable rate

Alyse Hand: [00:28:18:26] Great. And you know, along with that, it’s so important to talk to other people, to professionals and friends and family who have bought homes before. You have those, you know, people that you can reach out to and ask them questions. Use those people, right? Clinton, do you recommend this is a big one tonight, maybe one of the most important questions. If you already are a homeowner especially, do you recommend a fixed or variable mortgage rate? With everything that’s gone on in the last few months and rates going up and up.

Clinton: fixed or variable rate

Clinton Wilkins: [00:28:48:17] You know, we’ve talked about this a lot. I am a big believer in a variable rate mortgage product. Personally, historically variable is better. I think everyone was probably surprised by the news that the bank can increase the overnight rate by 1%. So everybody who is in a variable rate mortgage is paying 1% more today than they were prior to the last increase.

But a lot of economists think that we may be in a recession type situation, you know, by late next year, which might mean that the rates will start to soften. So if you take a fixed rate today, they’re quite high. You’re fixed for the period of that term. With a variable, it’s going to go up and down. And I think we’re close to where the peak is. We’ll see what happens with inflation.

There were some inflation numbers out here the other day. In Canada, our inflation is almost where it was with the US. So I’m cautiously optimistic. Right now, historically, about 60% of Canadians will take a fixed rate because they want the certainty. They want to know what their payments are going to be, but there’s a cost to that. So first time home buyers, it’s a bit of a mix.

I think first time home buyers that have a little bit more room in their budget and they’re willing to take a bit of risk. Typically variable will pay off. But I think if your rate at the top of your budget, there’s nothing wrong with taking a fixed rate and paying a little bit more to have that security. So, I like variable myself, but it’s not necessarily for everybody.

Question ten: matrimonial property act

Alyse Hand: [00:30:20:19] So it’s not a one size fits all. You got to talk to a mortgage broker or talk to someone about it. Danielle, tell us about the Matrimonial Property Act. What are a person’s rights if they’re not on title?

Danielle MacLean: [00:30:32:01] My questions are so big.

Alyse Hand: [00:30:34:10] Oh, I know.

Clinton Wilkins: [00:30:34:28] That sounds like a legal question.

Danielle: matrimonial property act

Danielle MacLean: [00:30:36:10] I feel like I’m in law school right in the bar exam all over again. So Matrimonial Property Act is exactly what it sounds like. So matrimonial. So if you are married or you have opted in to a registered domestic partnership with vital statistics and registered as the key there, you have to formally go in to vital statistics and file this document. Then your property ownership is dictated in Nova Scotia by the Matrimonial Property Act.

So that means that even if your spouse is not on the property title, they’re going to have an automatic interest in the marital home. So where a lot of the misconception comes in, is a lot of people assume that common law is the same as being married when it comes to property law and it couldn’t be more wrong.

So I have people all the time that are terribly surprised or happily surprised, depending on who I’m representing, that they don’t have marital rights in property. So if you are common law, even if you file your taxes together, doesn’t matter.

When it comes to Nova Scotia property law, you do not have that automatic entitlement to the property. So the starting point is if you’re common law, whatever you brought in is what you get out with. If you’re married or you’ve opted into this legislation, then you’ve got 50/50 at whatever you brought in and whatever comes back out.

Danielle MacLean: [00:32:04:07] Now the problem is, and again, depending on which way you’re looking at it, is if you’re the owner of something and you’re in a common law relationship and you don’t have those cohabitation agreements and things fall apart, people can still argue equity, so they can argue fairness.

So they can say, “Oh, look, I contributed more than a reasonable rent. I put in a down payment. I walked the dog, I watched your kid. I made dinner every night. I rub your feet,” whatever. So they’ll try to quantify this. And then what happens is you end up going to court, it costs you all kinds of money, and it’s easier just to write somebody a check. And it’s very frustrating for all of us.

Alternatively, if you’re the person that wasn’t on title, you can find yourself in that terrible position where you’re trying to prove that you did have an interest. Maybe you’ve been with somebody for 10 years and you’re arguing you had an interest. So, you know, again, it’s important to just have things documented in particular, if you’re not both on title, but if you’re planning on moving somebody in and you’ve got any kind of equity or skin in the game there, you really should have something in writing just saying what’s going to happen if you do split up.

Jules Chamberlain: [00:33:09:00] Yeah, that was a big question for you. Imagine if she’d asked it of me, I would have just said, marry rich.

Clinton Wilkins: [00:33:16:08] Oh, you too. Sometimes it’s about love.

Danielle MacLean: [00:33:19:26] It’s hard because a lot of people, because you think common law and I have people say this all the time when we’re meeting to sign documents and say, are you married? Because we need to know that for mortgage purposes. And people say, I’m common law. And even from an inheritance point of view, if a common law spouse has no right to inheritance.

So if you don’t have a will and you’ve got a common law partner and they die, you get nothing their mom is going to inherit or their dad or their kids or whatever. So it’s really important that you have those discussions with your lawyer ahead of time, because we’ve had terrible situations where people have been together for 20, 30 years and somebody passed away and they didn’t have a will and they weren’t legally married and they weren’t entitled to the home that they’ve been living in.

Clinton Wilkins: [00:34:02:27] And I see it, honestly, a lot in the queer community. Like relationships are different. Not everybody wants to go through the legal marriage. I’m glad that we can, but not everybody wants that for themselves. But there are legal implications.

Danielle MacLean: [00:34:17:07] Well, and even just the younger generation, you know, there’s not such a focus on marriage as there was. There’s a lot more interest now in cohabitation agreements and pre-nuptials. Like when I started 20 years ago, you didn’t do that. And unless it was maybe someone on a second or third marriage, there was a big swing in income.

Now, that is part of the conversations that people are having with me up front instead of me kind of having the very unromantic conversation of, “Hey, do you guys do you have something? Do you have something together?” But it is people are a lot more open about that than they used to be. And again, I think that’s, a lot of it is the next generation coming up is much more aware and much less interested in marriage.

Question eleven: the right time to buy a home

Alyse Hand: [00:34:59:07] And more interested in protecting themselves, which they should be. Jules, when is the right time to buy? That’s the big million dollar question right now.

Danielle MacLean: [00:35:08:25] Three years ago. No.

Jules Chamberlain: [00:35:10:08] No, no. Actually,

Clinton Wilkins: [00:35:12:04] I vote today.

Jules: the right time to buy a home

Jules Chamberlain: [00:35:13:09] I want to say now. But actually it’s more fair to say when you’re ready, line up your ducks or whatever it is that you need to line up. There’s no bad time to buy.

But the important part is to be ready. And that could be today, or it could be tomorrow or could be next year. Because there isn’t a bad time to do it. It’s just important that you do it smart. Buy smart.

Clinton: the right time to buy a home

Clinton Wilkins: [00:35:40:09] And I’ll echo that. Honestly, I think the right time is when somebody is ready and I think it’s ready emotionally and financially. There’s a lot of reasons to be ready, but I think owning a home is typically the biggest asset in a household, so it’s the biggest purchase.

And for us, obviously, we think it’s the biggest debt. You need to be ready to take that on. But the one thing I can say, if you do own a home and you’re getting into that property ladder, typically your property is appreciating and you’re paying down the debt. So your net worth is typically growing every month, which I think is pretty cool.

Question twelve: bankruptcy and homeownership

Alyse Hand: [00:36:18:10] Now, I’ll be honest, I refinanced recently and it was a really good move for me. So look at that too. If you have a home and you’re doing okay with the mortgage payments, think about maybe refinancing and you might find yourself kind of in a better position. I want to get to because just looking at the time, we had some more questions, but I’m going to skip over them.

Clinton Wilkins: [00:36:34:12] I think we should get the audience.

Alyse Hand: [00:36:35:17] I want to get you guys involved.

Clinton Wilkins: [00:36:36:15] I’m sure you guys have some questions probably.

Alyse Hand: [00:36:38:09] Do you have questions?

Clinton Wilkins: [00:36:39:11] Oh, yay. Perfect. We’re going to bring a mic over just so our friends at home can hear you as well.

Audience Member One: [00:36:45:19] Hi. Please be brutally honest. How much does a bankruptcy affect your likelihood for getting approved for a mortgage?

Clinton: bankruptcy and homeownership

Clinton Wilkins: [00:36:59:13] We lend people money one day out of bankruptcy. So typically what I say and I’ll answer the question, but I’ll let you guys speak to it as well, I’m curious to know what the legal implications are. But one day out of bankruptcy, you can get a mortgage. When you’re in bankruptcy may be more challenging.

So when you’re one day discharged, even if you don’t have any re-established credit, you can get a mortgage. But the one thing I will say, the harder the file, the more skin you need in the game. So the down payment might be higher and you’ll typically pay a higher rate.

What we say, any time that you’ve gone through something like a bankruptcy or a consumer proposal, we call it like the two, two, two rule. Two years, have two new pieces of credit with at least $2,000 limit and make all your payments. Even on your cell phone, even on your student loan. Notorious. Those are the things that we see that there’s issues with and keep it clean. That’s my word of advice.

Jules Chamberlain: [00:37:54:29] I thought two, two, two was a ballet reference.

Clinton Wilkins: [00:37:56:25] Maybe not a ballet reference. So typically one day out of bankruptcy are probably looking at like 35% down and that can be saved or gifted typically. And believe it or not, we actually see a lot of borrowers right out of bankruptcy or a consumer proposal buying a home or doing a mortgage transaction. So it’s actually quite common.

Jules Chamberlain: [00:38:17:03] It’s often more challenging, but it is possible.

Danielle: bankruptcy and homeownership

Danielle MacLean: [00:38:20:20] You know, you’re going to have, to Clinton’s point, it’s a more complex file. You’ll have a more complex lender. There’s tends to be a lot of extra fees associated with that. You do have to be discharged because until you’re formally discharged, anything that you were to buy the trustee owns, until you’ve got that actual discharge.

But anything, anything is possible. It’s not roadblock that you’re kind of led to believe that it is. Clinton’s team does a lot of complex credit lending. They’ve got a broker here that does a lot of it. And I do a fair bit of that with them.

Distraction about Halifax’s summer pedal tour

Clinton Wilkins: [00:38:54:12] Great question.

Alyse Hand: [00:38:55:11] That bus? As they go by.

Clinton Wilkins: [00:38:56:05] Oh, it’s the pedal tour.

Alyse Hand: [00:38:58:07] Oh, this is new. Okay, cool. I’m getting some story ideas for the morning news.

Danielle MacLean: [00:39:02:25] Is that a drinking pedal tour? Like a wine?

Alyse Hand: [00:39:05:02] That’s amazing. Hey, guys!

Danielle MacLean: [00:39:07:24] It’s like free calories.

Clinton Wilkins: [00:39:09:01] Hopefully, we’ll keep your interest for at least another 15 minutes.

Question thirteen: student debt and homeownership

Alyse Hand: [00:39:11:13] Did that answer your question? Any follow up questions? Great. Great question. And good on you for asking. Anyone else in the crowd have any questions over here?

Audience Member Two: [00:39:29:15] Just yell. If I’m not loud enough, I’m losing my voice a little bit. So for first time home buyers, a lot of us have considerable student debt. What’s your best advice for buying your first home when you’re also making, you know, pretty substantial student loan payments?

Clinton: student debt and homeownership

Clinton Wilkins: [00:39:48:27] In terms of qualification, I often see people who try to speed up paying their student loans down, like speed up making the payments. So increasing your payments. Getting the debt paydown faster isn’t necessarily the solution.

It’s really about the monthly liability. So I would figure out what the minimum is that you need to pay on those student loans, and that’s typically what I would set it at while you’re buying a home and then once you own the home, then you can speed it up again.

I have a lot of buyers that are putting $1,000 a month on their Canadian student loans when they’re minimum payments, $300 a month. That makes a big difference when we’re looking at qualifying. So that’s one thing to take into account and if there’s any revolving debt, so a student line of credit, we will take 3% of whatever the remaining balance is.

So if you’re looking at paying out any debt before you want to go buy a home, it’s always better to pay out the revolving debt versus the instalment. So an instalment would be something that you’re making a regular monthly payment. Revolving is something typically like a line of credit or a credit card. Hopefully that helps.

Danielle: student debt and homeownership

Danielle MacLean: [00:40:58:10] Are you more focused on making the mortgage payments or kind of how you would look from a qualification point of view? Yeah. Have you thought about maybe co ownership? So that’s something I’m seeing more and more now. Like people kind of friends buying together. We could do a little partnership agreement and kind of detail how things are going to look. They have to come up with half the down payment and you look twice as good on paper. In theory, and you’ve got half the payments.

Clinton part two: student debt and homeownership

Clinton Wilkins: [00:41:25:01] And sometimes we see three and four borrowers on a mortgage application, I’ll be honest with you, I had some borrowers that actually just closed on their home. And as a matter of fact, Danielle may or may not have been their lawyer, and 17 years ago, there were a lot of questions.

You know, if there were two men on application or two women on an application, imagine a non-binary person on an application. There were a lot of questions that the lenders and the insurers would come back and ask us. And now it’s so much more normal that we can have three single people on an application.

And I think the risk that the lenders thought they’re like, “Well, this relationship, whether it is a romantic relationship or not, is going to break down and put the lender at risk.” But I think even outside of Atlantic Canada, the homes are just so much more expensive than they are here. It takes sometimes multiple borrowers to be able to qualify. So it’s becoming really much more normal from what I’m seeing.

Danielle MacLean: [00:42:26:15] I’m seeing more and more. I’m seeing more and more of that. So it’s just something to think about. If you do have a roommate or something and you’ve got the down payment there, the other option would be to look at something that has a rental suite in it. So you could have a little bit of rental income in there to kind of pad it a bit for you.

Clinton Wilkins: [00:42:42:18] And it’s really great to pay down your mortgage. I’ve actually owned a multifamily before where I’ve lived in one unit and I’ve rented out the other two units and I was almost living for free. It doesn’t really help with the qualification because we only use 50% of the rent towards your gross income

So it’ll help a bit, but just on a monthly basis. Such a big, big difference, which is kind of cool, if that’s really where you want to be. And I think it kind of brings back to me like what a first time home buyer really is. And I think the needs and the wants have changed a little bit. I’ll be honest with you. I know I may be going a little bit off topic, but a lot of first time home buyers today are trying to buy their dream home.

And I think we’re kind of shifting back to maybe more of that starter home type situation just because of what’s going on with the price. But a lot are asking, are the prices going to go down? And I think this is kind of the new normal. So we’re working with what we have and I think things are going to start plateauing until we get a lot more inventory on and they’re going to get back to more of a normal market.

And maybe, Jules, you can speak to this, but in Halifax, we traditionally have seen like 1, 2, 3% growth. It’s been obviously double digit growth the last couple of years.

Jules: student debt and homeownership

Jules Chamberlain: [00:43:48:04] Yeah, you know, it’s not been a bubble. It’s been more of an adjustment. Nobody has a crystal ball. We don’t know what’s going to happen. We don’t know what’s going to happen in the world, altogether. But the anticipation is that prices may plateau, but we’re not expecting them to drop because we’re still affordable in relation to other places in the country.

To the starter home aspect, I would say start realistic, you know, and start building equity. And then later you can either use that first home, that starter home to start a portfolio. If you feel like being a landlord and you have that opportunity to do that and buy a second one or you can then use that equity to buy your second home and then work your way up. If you aim for the dream home too fast, you might.

Clinton Wilkins: [00:44:44:03] Sometimes you just have to wait. Yeah. And there’s nothing wrong with waiting. But I think the people who are waiting that have waited now two and three years, some of them are kicking themselves and they really wish that they would have pulled the trigger in like 2019 or 2020, because the rates are a little higher now. But also the cost of the real estate obviously is higher, too.

Jules Chamberlain: [00:45:02:20] We don’t have a crystal ball for the future. But you know, when we look at stats over the past many years, even decades, we’re fortunate to be in a city and an area that has a mixed economy. And we basically have a stable ripple that equates approximately 3% year over year, decade over decade. Right? That’s a way more fortunate situation and something that we can work from and anticipate that it’s much more stable.

Clinton Wilkins: [00:45:32:14] Like we haven’t had the boom and bust, which is kind of cool. I’d love to get some more questions. I know we only have a few minutes left.

Alyse Hand: [00:45:37:08] We’re running a little tight on time. Do did that answer a question? Any follow up questions or you’re good with that? Yeah. She’s saying she has a partner and they both have student loans. So if she was to do the cohabitation thing, she’s still kind of SOL. So, I mean.

Clinton Wilkins: [00:45:56:14] But, you know, I think sometimes it’s really the income and the indebtedness. It’s not just the debt. I think really look at the payments. I think the payments are really what you need to think about. And if it’s amortized over a longer period of time, that will help. So I think there’s definitely maybe something there. And I think having two income certainly does make a difference.

Question fourteen: Nova Scotia Down Payment Assistance Program

Alyse Hand: [00:46:15:16] Okay, great. Any other questions before we kind of get to some rapid fire questions from the panel? This is your chance. Any takers? Okay. Thanks for your questions, guys. This is we’ve actually answered quite a few of them already in just our conversation. So I’m going to dive into this fourth rapid fire question, which maybe I’ll start with you, Clinton, on this one, I think you or Jules or Danielle, would you recommend the Nova Scotia Down Payment Assistance Program? Maybe Jules, start with you here.

Jules Chamberlain: [00:46:43:19] Oof! Well.

Alyse Hand: [00:46:46:01] What is it? And what is the Nova Scotia Down Payment Assistance Program?

Jules Chamberlain: [00:46:48:26] Well, it’s assistance if you qualify. So the first thing I would say is look into it. It’s there, it’s available for certain people. It’s easy to look it up on online, on Google. There are criteria for eligibility, right? And it’s a loan that is ten years.

Clinton: Nova Scotia Down Payment Assistance Program

Clinton Wilkins: [00:47:12:18] Yeah, it’s a ten year interest free loan. And you know what’s really cool? The province of Nova Scotia are right across from province house here at 5151 George, they extended the program for Nova Scotia. It used to be in Halifax.

You can only qualify to buy a home at $300,000. And let me tell you, there’s not too many homes at $300,000 right now. They’ve increased the limit to $500,000 and it’s a 5% interest free loan over 10 years. It basically turns into a second mortgage and the household income can be a maximum of $145,000.

So $145,000 household income can definitely qualify for a $500,000 purchase. And that’s the 5% down. You cannot have that money available in terms of savings. So if you have savings, you can’t do the program. It’s for people that don’t have the savings for the down payment, but they have enough maybe for the closing costs and stuff like that.

We’re seeing more now because it’s been obviously extended to that $500,000 range. The one word of caution is it may increase your legal fees and not every lender will entertain that program.

Danielle: Nova Scotia Down Payment Assistance Program

Danielle MacLean: [00:48:18:04] Yeah, the other thing with those loans is they are interest free, but there’s still a cost.

Clinton Wilkins: [00:48:24:01] Still a payment.

Danielle MacLean: [00:48:24:21] So when you pay it off. When you pay it off, they’re going to look at the equity that you have from the date that you purchase a property. So if you purchase for $300,000 and when you pay it off, whether you sell it or you refinance or you just come up with the cash and you can pay it off at any time. But say when you pay it off, the house is worth $200,000 more. You’re going to pay.

If you borrow 5%, you’re going to pay back 5% of that equity. So they’re great to get your foot in the door if you don’t have that down payment. And even though it sounds like it’s interest free, it’s something that you should really focus on paying off when you can.

So I say to my clients, when you get your tax return back, throw it on that, get rid of it quicker. Because if you’re in an area that’s going to have those big equity jumps, it may end up costing you an awful lot, but fantastic to get your foot in the door if you don’t have those big down payments that you need. It is a second mortgage.

So there is a little bit more of a cost there because we’re doing two separate mortgage transactions. Most lawyers, I think you’ll find, will give you a pretty good break on that because we’re already we’re already in there meeting with you.

Clinton part two: Nova Scotia Down Payment Assistance Program

Clinton Wilkins: [00:49:28:19] And there’s actually two programs, which is kind of interesting. And I think this is something interesting to note. And I think if you’re buying your first home, this is both for first time home buyers. The province has their program, which is the down payment assistance, and the federal government also has a program now that can’t be mixed. It’s one or the other.

Let’s say that you do have money for the down payment, but you want to have a bigger down payment, as long as you have the first 5%. Whether that’s saved or gifted, the federal government will increase the down payment as well, up to 10% for resale home and up to 15% for a new construction. And the federal government recently they put a cap.

Danielle MacLean: [00:50:05:24] Yeah, I don’t see a lot of those.

Clinton Wilkins: [00:50:07:08] Not as many now see many.

Danielle MacLean: [00:50:08:28] I don’t see many of those.

Clinton Wilkins: [00:50:11:05] And especially in an increasing value environment, I think that people are a little bit gun shy on programs where, you know, the federal government may be in bed with you, so quote unquote with a piece of the ownership of the house.

So I think people are a little bit apprehensive, but I think we’re going into a period where maybe the values are going to level off and it might be a good program again. So certainly something to think about. And I, you know, there are funds available out there to either help you with the down payment or to increase the down payment, which I think is kind of cool.

Danielle part two: Nova Scotia Down Payment Assistance Program

Danielle MacLean: [00:50:41:04] Just want to give yourself a little bit of time if you’re going that route, too. So I think you have to go physically down into the office. Nova Scotia, you have to produce actual paper.

Clinton Wilkins: [00:50:48:13] Real documents like pieces of paper.

Danielle MacLean: [00:50:49:29] It takes a little longer.

Clinton Wilkins: [00:50:51:00] They need a letter from your mortgage lender.

Danielle MacLean: [00:50:53:03] So, you know, let your realtor know if that’s something that you’re looking at so they know to build it a little bit more time in there for your financing.

Clinton Wilkins: [00:50:58:03] You’re probably not closing in two weeks.

Danielle MacLean: [00:51:00:02] No please don’t try that anyway. That makes your lawyer sad.

Question fifteen: how do clients find you?

Alyse Hand: [00:51:03:17] Yeah time management for sure and trying to do that ahead is always best. We only have a couple of minutes, so I thought I’d end it with a couple questions that I thought would help our audience, both here in person at home the most, which I want to ask you, Danielle, and maybe you can both answer as well. How do you know when you have, like how do you find a lawyer? How do you know who’s good? And the same goes for real estate agents and mortgage brokers. How do you really know how to find the right one?

Danielle: how do clients find you?

Danielle MacLean: [00:51:31:14] I think 90% of my clients would be either repeat business or referrals. So, you know, as somebody, you know, that bought a house, did you like your lawyer or did you hate your lawyer? You know, a lot of times, like a lot of my referrals will come from my realtors, my brokers, people that work with me.

Find somebody that you’re comfortable with. I would say with real estate law, find somebody that focuses on real estate law. It is not an area that anybody should dabble in. I consider that kind of the equivalent of going to a doctor for a toothache. You know, you should be going to a dentist.

Clinton Wilkins: [00:52:05:10] So go to the professional.

Danielle MacLean: [00:52:06:25] Go to the professional and make sure you have somebody that’s experienced in there. You know, click on, read their bios, that sort of thing. There is an association, there’s the Nova Scotia Real Estate Lawyers Association, Relance. So if you go on their website, they have a lot of Nova Scotia lawyers on there. So I would suggest kind of starting there to find a real estate lawyer. Or you could just call me. That works, too.

Jules: how do clients find you?

Jules Chamberlain: [00:52:29:11] Yeah, likewise. Over 90% of my business comes through referrals. Talk to people that, you know, that have worked with people and ask them if they say, “Oh, this person’s is great,” you know, ask them how or why, you know, ask them how their transaction went and that that’ll help you identify, right?

Alyse Hand: [00:52:50:02] You can interview. This might be common knowledge. You can bring in a number of real estate agents. They are working for you, right? So bring them in, talk to them, ask questions. You can go online. There’s a whole list of Google questions you can ask potential real estate agents.

Jules Chamberlain: [00:53:01:13] And don’t be shy to enter into a contract with a real realtor because it’s, you’re retaining them to advise and represent your best interest. And actually, when they sign on, when I sign on, it’s my job to follow your legal, lawful instructions. I’m there to advise you and to help you and guide you and all that stuff. But you’re the boss, so it’s not actually a scary contract.

If after a while it doesn’t work out, you can actually break that contract. So, you know, it’s just if you’re hiring a professional, whether that’s a lawyer or, you know, or any profession is if you retain them, then you’re also hiring them to fully give you all that advice they pay for errors and emission insurance, all that stuff. They’re there to fully represent your interest and guide you through all that.

Question sixteen: mortgage broker vs bank

Alyse Hand: [00:54:03:15] Clinton, I’m going to let you have the final word since this is your event. I just think the bottom line I think I might have asked you this when I did my very first TV interview with you is why should someone go with, say, a mortgage broker over the bank? You know, I think that’s the big why. Why is what’s the benefit of going with someone like you over RBC or BMO or whatever?

Clinton: mortgage broker vs bank

Clinton Wilkins: [00:54:21:21] Well, Alyse there’s mortgage lenders and there’s banks and credit unions on every corner. And I think the big thing that sets us apart from maybe the bank branch is this is the only thing that we do all day every day. Maybe some of you do work in in bank branches right now.

I know there’s bank branches just a couple of doors down from here where our office is actually in an old bank branch. So banks are really our friend, but we’re not doing credit cards and loans and bank accounts every day. We’re just doing that one widget, which is mortgage lending and it’s very, very complex. And in Canada there’s so many nuances to the different mortgage choices and typically we deal with about 40 different lenders.

You know, there were some questions around credit and, you know, first time home buyers, not every lender is the best fit for everyone, but we have access to a lot of different lenders and we’re doing this all day. So we can look at the assets and we can look at the credit and we can look at the income and really give our expert advice on what the best way forward is.

And for us, about 60% of our clients are repeat. So I think that really speaks to the advice that they’re given. And we really believe that we’re in business with our clients really for the next 25 years. So we really do love the repeat and we obviously love the referral.

And I think mortgage brokers are now more important than ever, especially, you know, we’ve just made it through a challenging time where a lot of us were stuck at home. We were still here doing mortgage lending every day, some of us from home, some of us from the office, and we were still able to transact. And, you know, I think that has a lot of value. We did some transactions.

Alyse Hand: [00:56:05:23] And I always thought a common misconception is mortgage brokers are going to cost you more than going to the bank, but that’s not the case. So you’ll learn a lot, kind of you dig into it. I just want to. I know, Jules, you’ve got one last thing to say. Yes.

Final notes of encouragement for first time home buyers

Jules Chamberlain: [00:56:18:08] Well, just a little word of encouragement, because it’s so vast and complex and that for a lot of people, especially first time home owners, it seems daunting, but it’s also fun and really exciting.

Clinton Wilkins: [00:56:32:11] I remember getting my first keys.

Danielle MacLean: [00:56:34:10] I love telling people that they’re closed. My new home buyers are so excited. I love it.

Clinton Wilkins: [00:56:40:27] We’ve made a few dreams come true.

Alyse Hand: [00:56:44:06] I had about 13 apartments before I bought my place. It took me until I was 34 to buy my first place. So it is a wonderful feeling if you can do it. It’s something that everyone can do. But you’ve certainly helped us all understand it better. And thank you, Clinton, Jules and Danielle, for the knowledge and the advice tonight. Thank you so much.

Clinton Wilkins: [00:57:01:28] Thanks, everybody.

Alyse Hand: [00:57:02:18] Thanks, everybody out there in the cyber universe, too. And this will be online to you if you guys missed anything. You want to hear answers again. It’ll be up on Facebook and on YouTube. Thanks, guys. Thanks for coming out. Enjoy the rest of your evening. Happy pride.

Clinton Wilkins: [00:57:15:22] Happy pride.

If you have any questions, get in touch with us at Clinton Wilkins Mortgage Team! You can call us at (902) 482-2770 or contact us here.