Clinton Wilkins joins Todd Veinotte on 95.7 News Radio to discuss The Bank of Canada holding its key policy rate at 2.75%, marking the first pause after seven consecutive cuts.

What’s on the way for next week’s Bank of Canada announcement?

The second-last Bank of Canada announcement of the year is next week, and many people are wondering what the central bank will decide for interest rates. In preparation for this announcement, here’s what we expect to see from the bank, and what it will mean for you.

What should we expect next week?

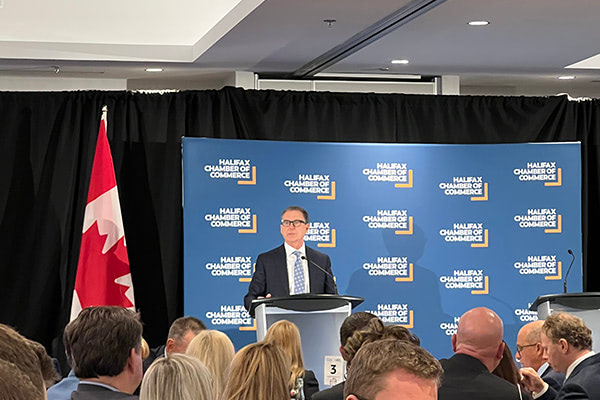

We attended the Halifax Chamber of Commerce luncheon on October 4th, where the Bank of Canada’s Governor, Tiff Macklem, was keynote speaker. This was his first in-person address since becoming Governor. He was open about doing whatever it takes to bring inflation under control. Since inflation is still above the bank’s target level, we are expecting to see another increase to the overnight rate. The overnight rate is currently at 3.25 per cent. A rate hike will once again increase the cost of borrowing, which will impact new buyers as well as current home owners with a variable-rate mortgage.

What will this mean for the odds of a recession?

The bank has been clear that more rate hikes are on the way, but it’s important to acknowledge that with rate increases comes the risk of a recession. Higher interest rates reduce purchasing power, lower demand, and slow the economy. This will help the bank meet its inflation target, but it likely means we will face an economic downturn. Many economists are predicting a recession for Canada in 2023.

How can you prepare?

The knowledge of an upcoming recession can be scary, so what can you do to prepare? If you’re a home owner, your mortgage payments will be your priority. Cutting back on non-essential spending now may help you deal with high interest rates and/or an economic downturn. You may also want to consider lengthening your amortization period so you can make smaller monthly payments, which can provide financial breathing room.

We still suggest hanging on to your variable rate if you have one. While it’s challenging trying to deal with seemingly endless rate hikes now, rates will drop if we hit a recession, saving you money on future payments.

A mortgage broker can be a great resource, and we’re here for all your mortgage needs. If you have any questions or want to discuss your options, get in touch with us! You can call us at (902) 482-2770 or contact us here.