The year is almost out. It’s time for our 2023 year in review! Here’s what 2023 looked like, and what to expect in 2024.

Year in review: That’s a wrap on 2021

2021 is coming to a close, and admittedly, not many people are sad to see it go. It was another year of change and challenge, and it’s impossible not to associate it with the troubles of COVID-19. However, it was also a year of growth, and we want to put a bit of a positive spin on our 2021 year in review. We’re very happy to call Nova Scotia home, and very proud of how we as Nova Scotians have come together this year. We at Clinton Wilkins Mortgage Team have confidence that we will navigate 2022 with the same energy!

As we round off 2021, let’s do one last review of the real estate market. It was a busy year for real estate and mortgages, so let’s see what happened!

A busy year for Clinton Wilkins Mortgage Team

We had lots of exciting changes in our office this year. First, we welcomed two new members to our team, Amanda Powell and Erin Vaughan! Amanda joined us as a business manager and commercial lender, while Erin is our newest fulfillment advisor. We’re so happy to have both of them on our team! You can learn more about Amanda and Erin on our team page.

We also opened a new office location on George Street in Halifax, just a few kilometres from our Wyse Road location! We’re super excited about this expansion, and we look forward to serving our community even better in the future.

Finally, it was another busy year for mortgages. We’re expecting to end the year with 830 deals valued at over 245-million, surpassing our 2020 record. We couldn’t have done this without the hard work of our team, business partners, and clients, and we thank you for being part of this journey with us.

Digital mortgage transactions are here to stay

Last year, we started seeing a big rise in digital mortgage transactions, from digital signatures to online documents and digital money transfers. In many cases, these changes proved to be more efficient and effective than previous in-person methods, even if the idea of virtual mortgages took some getting used to. Digital mortgages are likely here to stay, due to their ease of use and accessibility. We want to assure you that while change can be intimidating, we have been growing with these challenging times to prevent our clients from falling behind. All digital transactions with us are safe and secure, and we look forward to embracing digital solutions in the future.

Low interest rates

Does the term “historically low interest rates” ring a bell? It’s been repeated constantly throughout the last couple of years, including by us! As you may remember, the Bank of Canada lowered the target for the overnight rate to 0.25 per cent in March 2020 in response to COVID-19. This change was made to help support the Canadian economy throughout the worst of the pandemic, so the cost of borrowing would be lower for struggling Canadians. As part of our 2021 year in review, we’ll remind you we saw no changes to the policy interest rate or overnight rate. There wasn’t a huge amount of movement for interest rates this year, but the low rates allowed many people to enter the market. This contributed to the huge boom we’ve been seeing in the real estate industry.

Rising housing prices

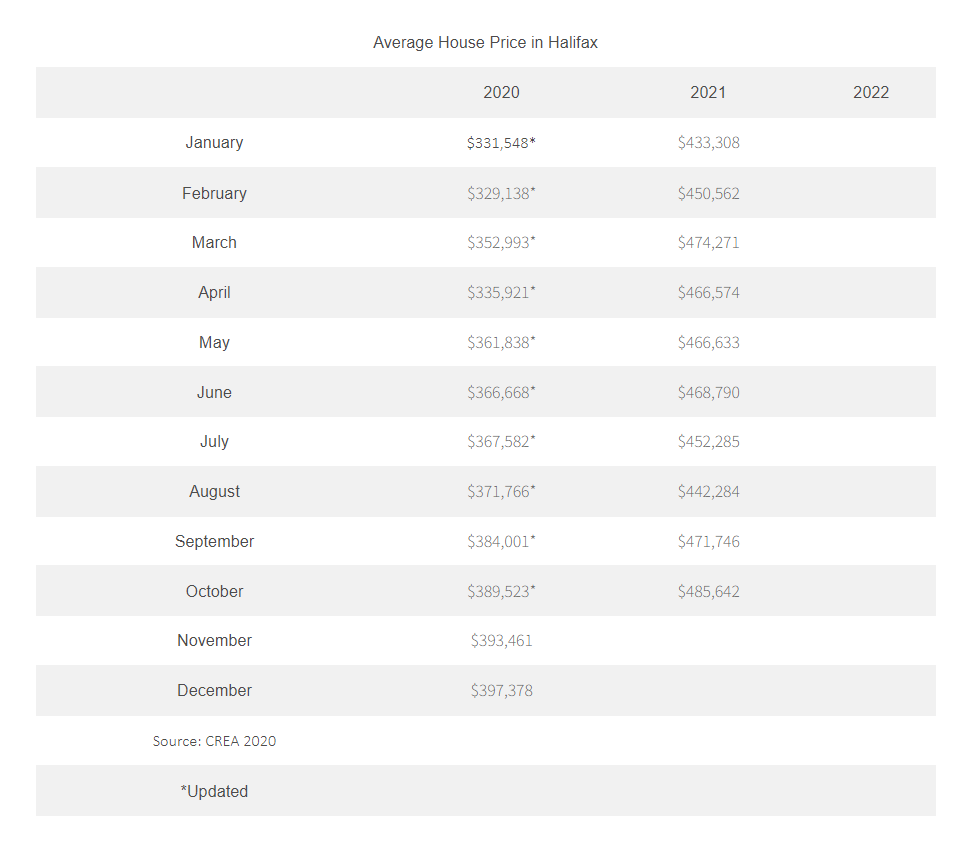

As we mentioned above, low interest rates have caused a lot of people to enter the housing market. Plus, the rise in remote work has permitted many people to move from cities like Toronto to Canada’s east coast, where affordable housing is a bit easier to find. This has caused huge amounts of competition, and therefore, big housing price increases. In this seller’s market, we have seen very low inventory and high demand, which allowed sellers to get big prices for their homes. According to The Canadian Magazine of Immigration, as of October 2021, the average house price in Halifax was $485,642. This is a 24.7 percent increase from October 2020. Prices across all housing types have increased. You can see more information on housing price increases below.

(Source: The Canadian Magazine of Immigration)

Are you ready to buy a home?

2021 has proven to be one of the busiest years on record for real estate, not just in Halifax but in several parts of the country. With that in mind, are you thinking of buying a home this winter? If so, winter is generally the slowest time of year for real estate. There’s often less competition, but also less supply. If you’re considering buying a home, be sure you’re ready. Buyers should have a down payment in place as well as a solid idea of budget and location. You should also have low debts and a high credit score to get approved for the best rates and products.

Should you refinance your mortgage?

Current home owners have had good opportunities to refinance their mortgage in 2021. By refinancing, many home owners have lower monthly mortgage payments, shortened their term length, or used their home equity for renovations. If you’re a home owner and didn’t refinance this year, should you consider it in 2022? While interest rates are likely to rise next year, we don’t exactly know when. Until they do, you may be in a good position to refinance if you can secure a lower interest rate. However, be sure you will save more money from a refinance than you might owe in fees for breaking your current mortgage terms.

Looking ahead to 2022

2022 will likely bring us an increase in interest rates, and potentially smaller housing price increases. Digital work is here to stay, as are digital mortgage transactions. Our 2021 year in review shows this was another challenging year, and we still haven’t left COVID-19 behind us. However, as tough as the past couple years have been, we want to look forward to the holiday season, and hopefully a more positive year ahead!

Thank you!

As always, thank you for your support and trust in us. We hope to continue to be your source for unbiased mortgage advice, and want you to know the door is always open for you. Have a wonderful holiday season and New Year, and we look forward to seeing you in 2022!